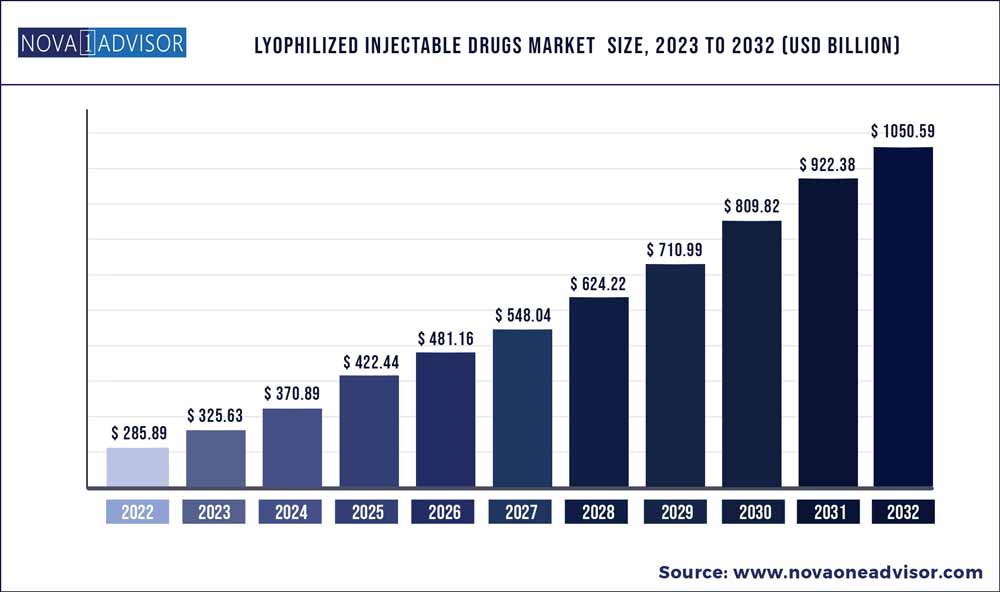

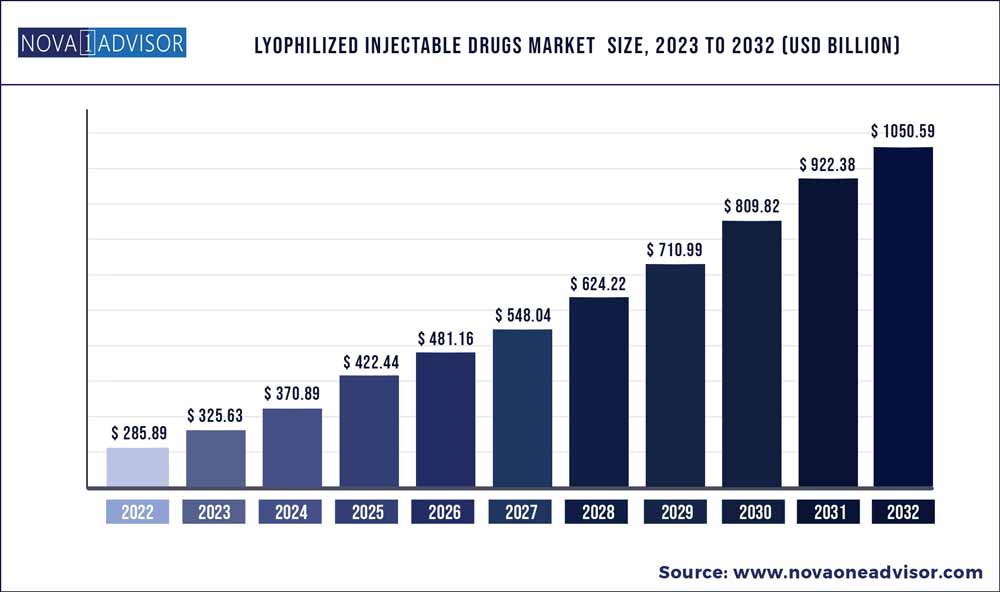

The global iyophilized injectable drugs market size was exhibited at USD 285.89 billion in 2022 and is projected to hit around USD 1050.59 billion by 2032, growing at a CAGR of 13.9% during the forecast period 2023 to 2032.

Key Pointers:

- North America lyophilized injectable drugs market held over 48% revenue share in 2022.

- Antiarrhythmic drugs segment accounted for over USD 20 billion in 2022

- Lyophilized injectable drugs market from respiratory diseases indication is anticipated to witness 13% CAGR between 2023-2032

- Lyophilized injectable drugs market from prefilled diluent syringes segment held more than 30% business share in 2022.

- Online pharmacy segment was more than USD 35 billion in 2022.

Lyophilized Injectable Drugs Market Report Scope

The report identifies the ongoing product approvals for critical drugs as a key factor driving the industry growth, with development of vast product pipelines across developed nations. Also, the emergence of novel diseases and the lack of treatment for several terminal illnesses has encouraged clinical studies. Various organizations are working towards securing approval for the use of lyophilized injectable drugs in cancer treatment.

Antiarrhythmic drugs segment accounted for over USD 20 billion in 2022. Rising demand for these drugs can be attributed to the increasing prevalence of cardiac disorders worldwide. In addition to this, this class of drugs is also heavily used in intensive care units (ICUs), which will augment the industry forecast.

Lyophilized injectable drugs market from respiratory diseases indication is anticipated to witness 13% CAGR between 2023-2032. The incidences of respiratory disorders have increased at a notable pace over the last decade on account of urbanization, rising pollution levels, changing lifestyle habits, excessive consumption of tobacco, and a constantly growing geriatric population.

Lyophilized injectable drugs market from prefilled diluent syringes segment held more than 30% business share in 2022. Prefilled syringes have gained considerable traction owing to several advantageous features such as improved handling and convenience, accelerating the use of drugs in home-care settings. These syringes help extend the shelf life of drugs without hampering their potency, which is expected to foster a sustainable rise in demand for lyophilized injectable medications.

Online pharmacy segment was more than USD 35 billion in 2022. A steady shift from pharmacy stores to e-commerce websites, notably driven by the emergence of the COVID-19 pandemic will foster the development of online platforms. Online or e-commerce shopping has multiple benefits such as easy and convenient purchases, discount offers, and availability of innovative products.

North America lyophilized injectable drugs market held over 48% revenue share in 2022. Rising cases of chronic diseases across the region, robust healthcare infrastructure and favorable reimbursement framework will bolster the industry expansion across the U.S. and Canada. Growing consumption of processed food, alcohol, and unhealthy lifestyle habits have contributed to rapid growth in the number of obese and diabetic adults. Continuous rise in healthcare R&D expenditure will offer significant opportunities for drug makers in the region.

Lyophilized Injectable Drugs Market Segmentation

| By Drug |

By Indication |

By Delivery |

By Packaging |

By Distribution Channel |

|

Anti-infective

Anti-neoplastic

Anticoagulant

Hormones

Antiarrhythmic

Others

|

Autoimmune diseases

Respiratory diseases

Gastrointestinal disorders

Oncology

Cardiovascular diseases

Infectious diseases

Metabolic disorders

Others

|

Prefilled diluent syringes

Multi-step devices

|

Vials

Cartridges

Prefilled devices

|

Hospital pharmacy

Retail pharmacy

Online pharmacy

|

Lyophilized Injectable Drugs Market Key Players And Regions

| Companies Profiled |

Regions Covered |

|

Bristol Myers Squibb

Gilead Sciences, Inc

F. Hoffmann-La Roche Ltd

Novo Nordisk A/S

Sanofi

Aurobindo Pharmaceuticals

Fresenius SE & Co. KGaA (Fresenius Kabi)

Merck & Co., Inc

Zydus Group

Vetter Pharma

Johnson & Johnson Services, Inc

Takeda Pharmaceutical Company Limited

Cipla Ltd.

|

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa (MEA)

|